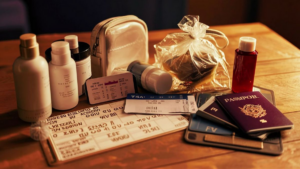

Embarking on a journey involves meticulous planning, and one crucial aspect travelers often ponder is the amount of money they can carry on a plane. Understanding the regulations and guidelines surrounding this matter is essential to ensure a smooth and hassle-free travel experience.

The Basics of Carrying Cash on a Plane

When it comes to carrying money on a plane, there are both domestic and international considerations. Different countries may have distinct regulations regarding the amount of cash passengers can bring with them. Generally, there is no strict limit on the amount of money you can carry, but it’s crucial to declare any amount exceeding a certain threshold at customs.

Domestic Travel Guidelines

For domestic flights, the rules tend to be more lenient. However, it is advisable to check with the airline and relevant authorities to stay informed about any specific requirements or restrictions. In most cases, you are allowed to carry a reasonable amount of cash for personal use without any issues.

International Travel Regulations

International travel involves a more detailed scrutiny of the money you carry. Most countries have regulations in place to combat money laundering and other illicit activities. As a result, there are limits on the amount of cash you can bring into or take out of a country. These limits vary, so it’s crucial to research and understand the rules of the destination country.

Declaration Requirements

Many countries require travelers to declare any amount of cash exceeding a specified threshold. This declaration is typically made on a customs form, and failure to comply can result in fines or confiscation of the funds. It is essential to be aware of and adhere to these declaration requirements to avoid any legal complications during your journey.

Security Considerations

While there may not be strict limits on the amount of money you can carry, it’s essential to consider security aspects. Carrying a large sum of cash may attract unwanted attention and pose a risk of theft. It is advisable to explore alternative forms of carrying money, such as credit cards, travel cards, or electronic payment methods, to enhance security during your travels.

Tips for Safe Money Handling During Travel

To ensure the safety of your funds while traveling, consider the following tips:

- Use secure money belts or pouches to keep cash hidden.

- Divide your money and store it in different locations to minimize the risk of loss.

- Opt for electronic payment methods for large transactions to avoid carrying excessive cash.

- Stay informed about the currency regulations of your destination country.

Carrying money on a plane involves a balance between personal convenience and adherence to regulatory guidelines. By staying informed about the regulations, making necessary declarations, and adopting secure money-handling practices, travelers can ensure a stress-free and enjoyable journey.

Frequently Asked Questions

Here are some commonly asked questions regarding carrying money on a plane:

| Question | Answer |

|---|---|

| 1. Can I carry an unlimited amount of cash on domestic flights? | No, while domestic travel rules are generally more lenient, it’s still advisable to check with the airline and relevant authorities for any specific restrictions or requirements. |

| 2. What happens if I don’t declare the exceeding amount of cash during international travel? | Failure to declare the specified amount at customs can result in fines or confiscation of the funds, emphasizing the importance of adhering to declaration requirements. |

| 3. Are there alternative methods to carrying large sums of cash for security reasons? | Yes, consider using secure money belts, dividing your money, and exploring electronic payment methods to enhance security and minimize the risk of theft. |

Managing Finances on Your Journey

Ensuring the safety of your funds involves not only understanding travel regulations but also adopting practical strategies for secure money handling. Here are additional tips:

- Stay updated on the currency exchange rates at your destination for better financial planning.

- Inform your bank about your travel plans to avoid any issues with using credit or debit cards abroad.

- Consider purchasing travel insurance that covers loss of money or theft during your trip.

Technology and Finance Integration

With the advancement of technology, travelers can leverage digital tools for seamless financial transactions and management. Mobile banking apps, contactless payments, and virtual wallets are becoming increasingly popular, providing convenient and secure alternatives to traditional cash.

See also: